When consumers are evaluating auto loans, they are often faced with a decision: should they take a rebate along with a higher interest rate loan, or forego the rebate in exchange for a loan with a lower interest rate. Both of these features are often key selling points in advertisements for new automobile purchases. These ads promote either a very low interest rate, or some sort of cash back on the purchase. This is always an either-or proposition – consumers must choose one or the other option.

This can be a confusing decision for potential auto purchasers. There is no hard and fast rule regarding the best option – this is almost entirely dependent on the variables involved – i.e., the interest rates being offered, and the amount of the potential rebate.

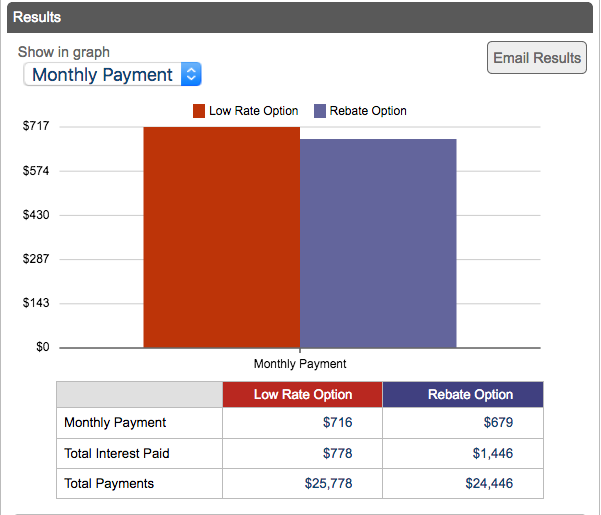

To help consumers facing this decision, VisualCalc has created the Rate vs. Rebate Calculator. This calculator helps you determine if a rebate and higher-interest rate financing option is better than a lower-rate loan without a rebate option. The calculator shows you the monthly payment, total interest, and total payment amount associated with each option. With this information, consumers can make an educated decision about the best option for their specific situation.